Someone Is Making A Massive Bet That Powell Ends The Party At Jackson Hole In August

One day after an commendable bubble-blowing performance by the uber-dovish Jerome Powell who warned of "froth" in stocks as a result of his own policies - and to think it was just 9 years ago when Powell admitted the Fed was blowing a fixed income bubble "that will result in big losses when rates come up" ...

... we are seeing a burst the “reflation” trade with Brent surging...

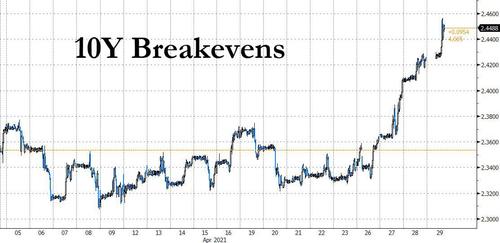

... which is lifting 10Y breakevens to fresh multi-year highs, printing at 2.45% this morning...

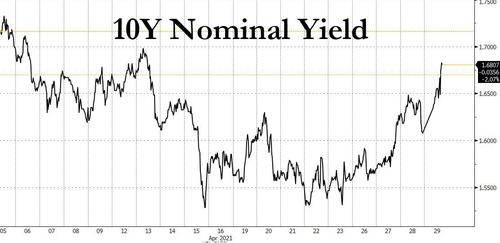

... and pushing 10Y yields to a level where traders are starting to sweat the impact of rising yields on stocks.

What is bizarre is that yields are spiking even as the Nasdaq is back to all time highs, largely on the back of blowout earnings from Google, Facebook and Apple. As a reminder, it was the spike in yields in late February that hammered high-duration (i.e., growth, tech) names although it now appears that the market has forgotten all about the negative correlation between higher yields and tech stocks.

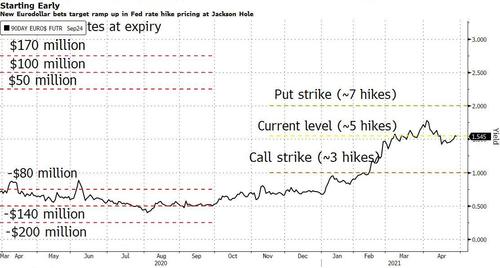

In any case, yields may just be starting their next big move higher: as Nomura's Charlie McElligott reminds us this morning, from a sequencing / timing perspective, "it is worth noting that in Eurodollar options, there has been a very large trade building the past few days which is anticipating a Fed hawkish shift in outlook built around the Jackson Hole event held in late August (Risk Reversal via Sep21 3-year midcurve options)."

Charlie picked up on an observation from Bloomberg's Edward Bolingbroke, who over the past few days has been describing a massive ED trade by an unknown entity, who appears to be betting that the Fed's dovish stance will end with a bang not in June, as many analysts predict, but in August with Powell making the inevitable taper announcement at Jackson Hole, which will lead to a bloodbath across the curve and especially the short-end.

Why Jackson Hole? Because last year, Powell unveiled a new policy framework for inflation, while in 2012 Ben Bernanke signaled more bond purchases were on the table.

Sure enough, over the past week, there has been a burst in eurodollar options activity involving a position that will benefit from a ramp-up in taper rhetoric in August. As Bolinkgbroke explained, the position is a risk reversal via Sep21 3-year mid-curve options. The Sep21 mid-curve options expire Sept. 10, before the Sept. 22 Fed policy meeting with the subsequent meeting on Nov. 3, expiration date appears to specifically target Jackson Hole for a taper-talk repricing in eurodollar futures.

Some more details:

Ahead of this year’s meeting, a large wager has been placed on a faster-than-expected pace of rate hikes before Sept. 2024, though with an expiry of this coming September.

As it stands, Eurodollar futures imply around five rate hikes, or 125 basis points of tightening by Sept. 2024. The new bet has been entered via risk reversals -- where investors buy options which pay off if rates rise but offset the cost by selling those which benefit from a fall.

The investor bought put options which target three-month Libor over 2%, which would equate to around seven Fed hikes, and sold those targeting rates below 1%, which implies slightly less than three increases. The rate rose 0.84 basis point on Wednesday to 0.1855%.

While the identity of the trader is unknown, this is rapidly becoming an "extremely high conviction" trade with exposure in the tens of millions: on Wednesday, 20,000 3EU1 98.00/99.00 risk reversal traded at 1.5, buying 98.00 puts, selling 99.00 calls, a continuation of a similar trade from Tuesday where 25,000 were put on for new risk, position has now grown to around 120,000 contracts since the start of last week.

The P&L profile is evolving, but as of Thursday morning, the strategy could generate around a $60 million payoff if markets price in eight hikes or an $90 million loss if expectations fall to two hikes. Needless to say, the trader is betting on the former.

Comments

Post a Comment